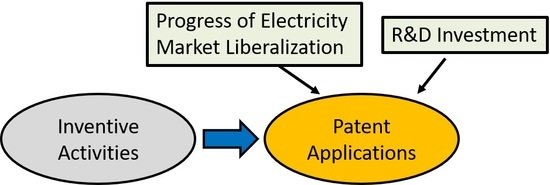

This study examines the marginal effect of Research and Development (R&D) investment and impacts of market liberalization on patenting activities of Japan’s nine incumbent electric power companies. We apply the negative binomial panel data regression model to a data set, comprising of companies from 1999 to 2018 and estimate four models. We find the following significant outcomes. First, retail market liberalization for high voltage consumers proves effective to increase patent applications. Second, R&D investment produces patent applications or a positive marginal effect of R&D on patenting is indicated. These results are consistent with previous findings in a way that deregulation to a certain extent facilitates innovation of firms but it may reverse the effect and decrease inventive activities after a threshold point. In addition, the results show a positive marginal effect of R&D investment on innovations; but the degree of the marginal effect declines with retail market liberalization for high-voltage consumers. This finding implies that innovation efficiency decreases due to the progress of deregulation. This result has critical policy implications; government policies for stimulating inventive activities of electric power companies are necessary and these should ultimately benefit consumers with advanced technology and reasonable prices for energy services.

【Published】Marginal Effect of R&D Investment and Impact of Market Reforms—An Empirical Analysis of Japanese Electric Power Companies

WRHI Newsおすすめ

Published

(School of Environment and Society / Dr. Toshiyuki Sueyoshi and Dr. Mika Goto)

“Marginal Effect of R&D Investment and Impact of Market Reforms—An Empirical Analysis of Japanese Electric Power Companies”

Energies (DOI:https://doi.org/10.3390/en13133354)

For details, click here

<Abstract>